Indonesia is the largest country in South East Asia with a relatively young, fast growing and increasingly urban population of almost 250 million. The economy is prospering, and growth over the past decade has averaged in excess of 6 percent per annum. As a result, the middle class has tripled to 150 million over the last five years alone.

This prospering middle class is driving demand for poultry products as they are one of the most affordable protein sources available to Indonesian consumers. Demand for poultry meat is expected to double within five years and, because of this, the Indonesian government is keen to support the development of the poultry sector in a sustainable way.

In 2013, a public-private initiative of Dutch companies active in the poultry value chain was established to work in close cooperation with their Indonesian counterparts to improve and strengthen Indonesia’s poultry sector.

Following a thorough examination of the market, FoodTechIndonesia has identified the challenges currently facing the sector and suggested how to improve the operations of medium-sized poultry companies, in particular.

Rapidly increasing demand

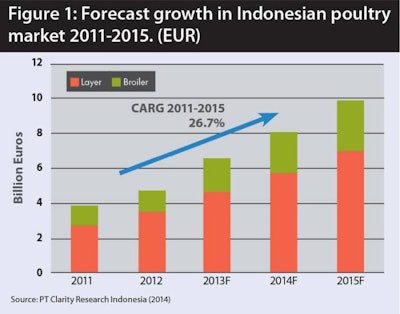

In 2012, the Indonesian poultry market was valued at EUR 4.76 billion (US$6.46 billion), with broilers representing 73 percent and layers 27 percent of the market.

Current consumption of poultry meat (7.36 kg/head/year) and eggs (74 pieces/head/year) are relatively low compared to other countries in South East Asia (Thailand: 20kg/160 pieces; Malaysia: 32kg/240 pieces).

Between 2011 and 2015 the poultry market is expected to grow by 26.7% (CARG) per annum to reach EUR 10 billion (see figure 1). To satisfy this growing local demand, investments in additional capacity are required and productivity, especially among small and medium sized enterprises, will have to increase significantly, mainly by introducing improved (knowledge-intensive) production systems.

Additionally, improved food safety procedures need to be implemented to ensure that healthy and hygienic chicken products reach the consumer.

Market structure

Indonesia’s poultry industry is geographically highly concentrated, largely in Western Java where more than 50 percent of primary production is located.

The market is dominated by a few vertically integrated players which, together represent about 70 percent of professional poultry production. These include Charoen Pokphand Indonesia, JAPFA, Malindo, Sierad and Wonokoyo.

Poultry farms

Only 2 percent of Indonesia’s broiler farms are fully closed houses, equipped with automated food and water systems and climate control. Typically, these farms host 100,000 –400,000 birds.

However, the majority – 95 percent - of Indonesia’s birds are farmed in small open houses, often built from bamboo, employing manual feeding and watering systems, and housing 3,000-20,000 birds. These farms are characterised by high mortality rates - up to 8 percent - as a result of disease and high temperatures.

Independent broiler producers are usually dependent on integrators for purchasing day old chicks, as the cost of investing in hatchery equipment is high. One solution to this would be the establishment of a hatchery through the co-operation of 4-6 independent farmers, who could share the capital investment, risk and then DOCs, suggests FoodTechIndonesia.

However, Indonesia currently lacks sufficient knowledge in embryology and hatchery management, meaning that its farmers need to be trained in storage and incubation conditions, data analysis, and hatching egg transport, for example. There also needs to be training on managing fertility and uniformity, the optimal use of hatching machinery and equipment as well as on post hatch performance.

At farm level, the high mortality rates that typify the sector, and low feed conversion rates can be partly attributed to open water systems and poor knowledge of disease control. Establishing demonstration projects showing the added value of closed water systems and extensive onsite staff training for example, would help to remedy these problems, the consortium believes.

Alongside this lack of understanding of avian health there is high use of antibiotics. Broiler farms are using high quantities of antibiotics for prevention and this is leading to bacterial resistance. The sector needs to develop alternative treatments, and invest in biological solutions, as well as introducing the market to antibiotic free products.

Chicken processing

Indonesia’s poultry slaughter and processing mostly takes place in backyard facilities. In Jakarta alone, over 2,500 backyard facilities have been identified.

Only 24 percent of the country’s chickens are slaughtered in abattoirs and only 34 poultry abattoirs hold a veterinary certificate allowing them to sell to modern supermarkets, fast food restaurants and hotels.

In 2007, the Jakarta government passed a local regulation banning slaughter within the city, however, to date, it has not been implemented. The current Jakarta governor has said that he supports implementation of the slaughter ban. Should it be finally implemented it will be a game changer as some 1 million chickens are consumed in Greater Jakarta every day and all will have to pass through recognised abattoirs.

Clearly, there needs to be significant investment in Indonesia’s poultry processing sector to address the lack of capacity. Yet capacity is not the only problem, and investment needs to be made in more efficient, sustainable and Halal-certified slaughter and processing systems. This would also raise the sector’s efficiency, while reducing the amount of product that leaves the processing plant damaged and improve shelf-life.

Many of Indonesia’s abattoirs have only basic waste water treatment plants, or no treatment facilities at all. This means that waste water enters the surrounding water system. Furthermore, useful animal by-products, such as feathers, fat and blood, are rarely processed into value-added applications such as blood meal, proteins and minerals which are used as ingredients for the pet food and animal feed industries amongst others.

There is a strong need for processors to invest in treatment projects. Demonstration projects, it is hoped, will show not only the effectiveness of treatment options, but also the economic value that such systems can bring.

Poultry feed

Indonesia is highly reliant on imported raw materials for animal feed, as local production is insufficient and typically occurs in remote areas located far from feed mills. Consequently, 50-80 percent of raw feed materials are imported. With such a high dependence on imports, locally produced animal feed is highly influenced by world commodity prices and exchange rates.

In 2013, for example, animal feed prices increased by 10 percent, however the Indonesian Rupiah depreciated by 26 percent against the US$. Price increases led to a slowdown of demand for chicken products while feed producers, unable to pass on the price increases, saw their profit margins decline.

Another difficulty is that the country’s feed mills often rely on outdated and inefficient equipment, often 15-20 years old, and many work in less than optimal ways. These facilities could be better utilised, and a first step would be through the use of audits and process improvements, FoodTechIndonesia says. In particular, operators need to look at feed formulation and composition, raw materials, energy use, water and other inputs, production processes and storage.